Roth Ira Brochure

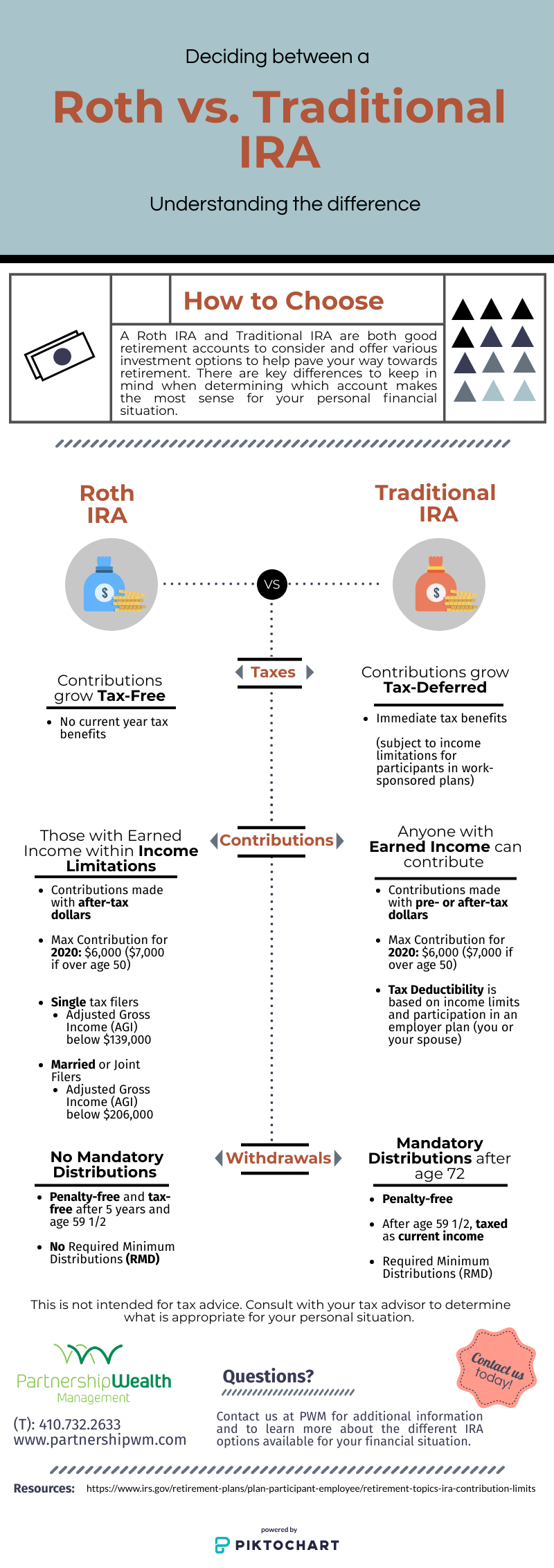

Roth Ira Brochure - Explore the differences between a traditional ira and a roth ira and decide which one is. What is a roth ira, and how does it work? You must log in to order. The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ Distributions of earnings from roth iras are free of income tax, provided you. Prepare for your future with a roth ira. Use this brochure to educate clients on the features and benefits of a roth ira. Investment toolsmarket insightsdigital investing programactively managed funds A possible tax credit of up to $1,000. A possible tax credit of up to $1,000. Distributions of earnings from roth iras are free of income tax, provided you. Investment toolsmarket insightsdigital investing programactively managed funds Prepare for your future with a roth ira. Use this brochure to educate clients on the features and benefits of a roth ira. Explore the differences between a traditional ira and a roth ira and decide which one is. A roth ira is an ira that, except as explained below, is subject to the rules. The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. There are two types of individual retirement arrangements (iras): Pmc’s brochures provide your customers and prospects with concise overviews of how. A roth ira is an ira that, except as explained below, is subject to the rules. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ There are two types of individual retirement arrangements (iras): What is a roth ira, and how does it work? Pmc’s brochures provide your customers and prospects with concise overviews of how. Distributions of earnings from roth iras are free of income tax, provided you. Use this brochure to educate clients on the features and benefits of a roth ira. A possible tax credit of up to $1,000. The roth ira is a nondeductible ira created by the taxpayer relief. There are two types of individual retirement arrangements (iras): Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ Distributions of earnings from roth iras are free of income tax, provided you. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. Search by title, subject, literature number, fund or cover description. Explore the differences between a traditional ira and a roth ira and decide which one is. What is a roth ira, and how does it work? A possible tax credit of up to $1,000. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. Prepare for your future with a roth ira. Pmc’s brochures provide your customers and prospects with concise overviews of how. What is a roth ira, and how does it work? Always free2022's 10 besttrusted by millionstrusted by 45,000,000+ You must log in to order. There are two types of individual retirement arrangements (iras): Printed materials from wolters kluwer help you stay compliant, simplify your processes and. Prepare for your future with a roth ira. Pmc’s brochures provide your customers and prospects with concise overviews of how. Search by title, subject, literature number, fund or cover description. Printed materials from wolters kluwer help you stay compliant, simplify your processes and. A roth ira is an ira that, except as explained below, is subject to the rules. Investment toolsmarket insightsdigital investing programactively managed funds A possible tax credit of up to $1,000. Distributions of earnings from roth iras are free of income tax, provided you. The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. Search by title, subject, literature number, fund or cover description. What is a roth ira, and how does it work? Pmc’s brochures provide your customers and prospects with concise overviews of how. Investment toolsmarket insightsdigital investing programactively managed funds The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. You must log in to order. Use this brochure to educate clients on the features and benefits of a roth ira. Search by title, subject, literature number, fund or cover description. Explore the differences between a traditional ira and a roth ira and. Explore the differences between a traditional ira and a roth ira and decide which one is. Pmc’s brochures provide your customers and prospects with concise overviews of how. A roth ira is an ira that, except as explained below, is subject to the rules. A possible tax credit of up to $1,000. Prepare for your future with a roth ira. Prepare for your future with a roth ira. Search by title, subject, literature number, fund or cover description. There are two types of individual retirement arrangements (iras): Printed materials from wolters kluwer help you stay compliant, simplify your processes and. The roth ira is a nondeductible ira created by the taxpayer relief act of 1997 that gives. Pmc’s brochures provide your customers and prospects with concise overviews of how. A roth ira is an ira that, except as explained below, is subject to the rules. A possible tax credit of up to $1,000. Explore the differences between a traditional ira and a roth ira and decide which one is. Investment toolsmarket insightsdigital investing programactively managed funds What is a roth ira, and how does it work? Always free2022's 10 besttrusted by millionstrusted by 45,000,000+Roth IRA vs. Traditional IRA

2014 roth ira brochure by Hudson River Community Credit Union Issuu

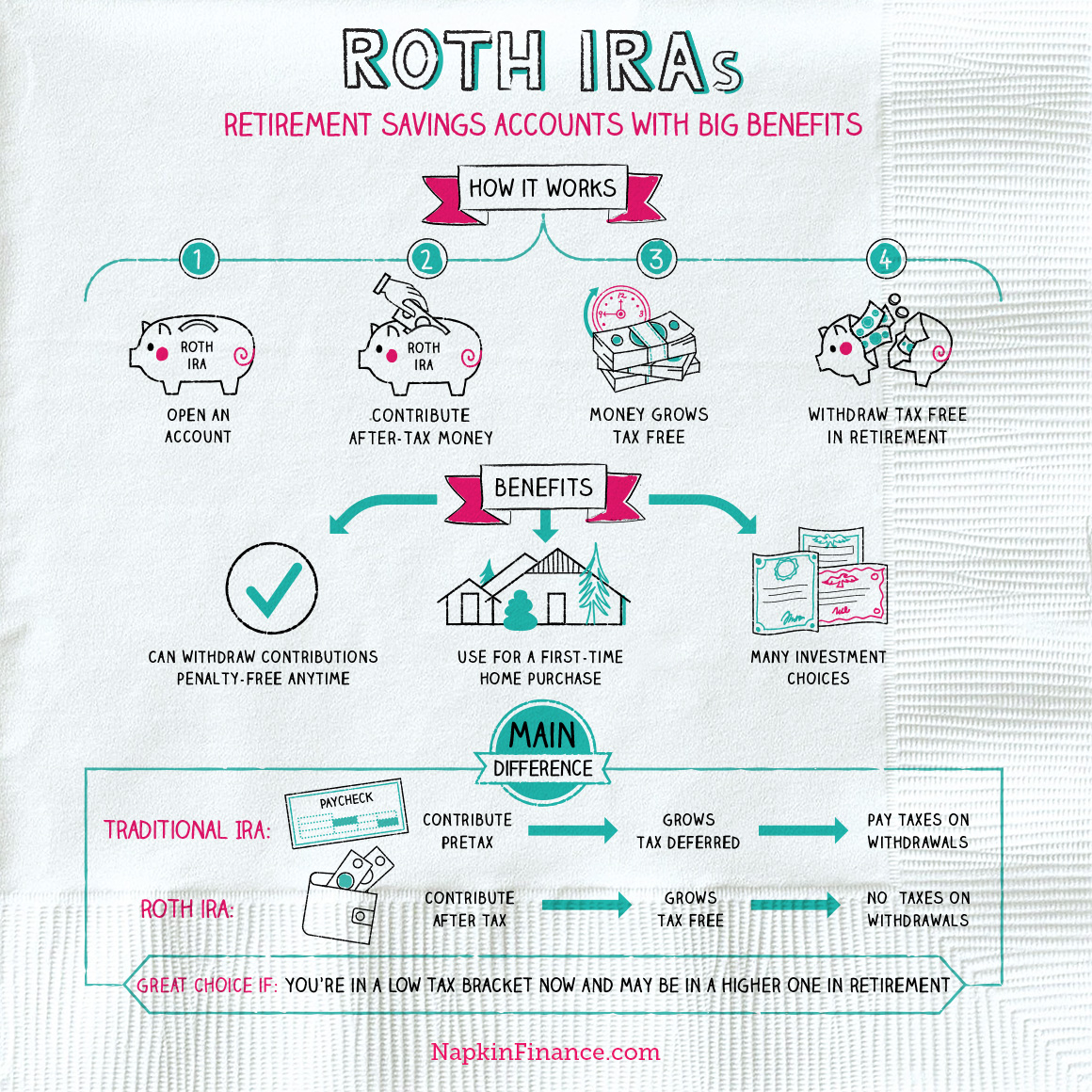

Roth IRAs Napkin Finance

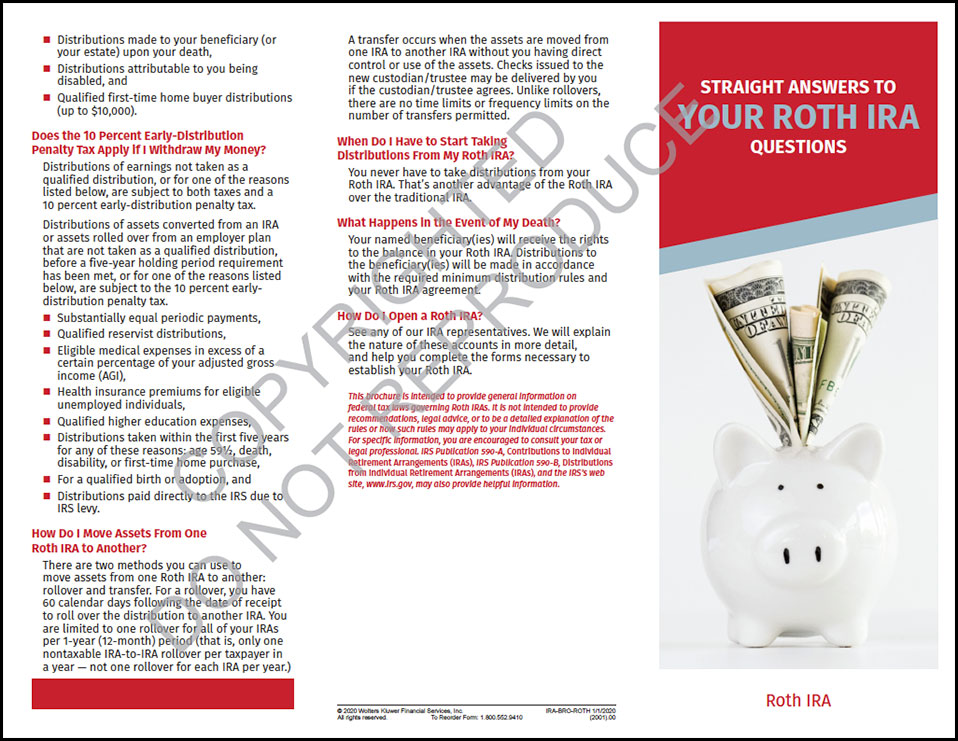

Straight Answers to Your Roth IRA Questions Wolters Kluwer

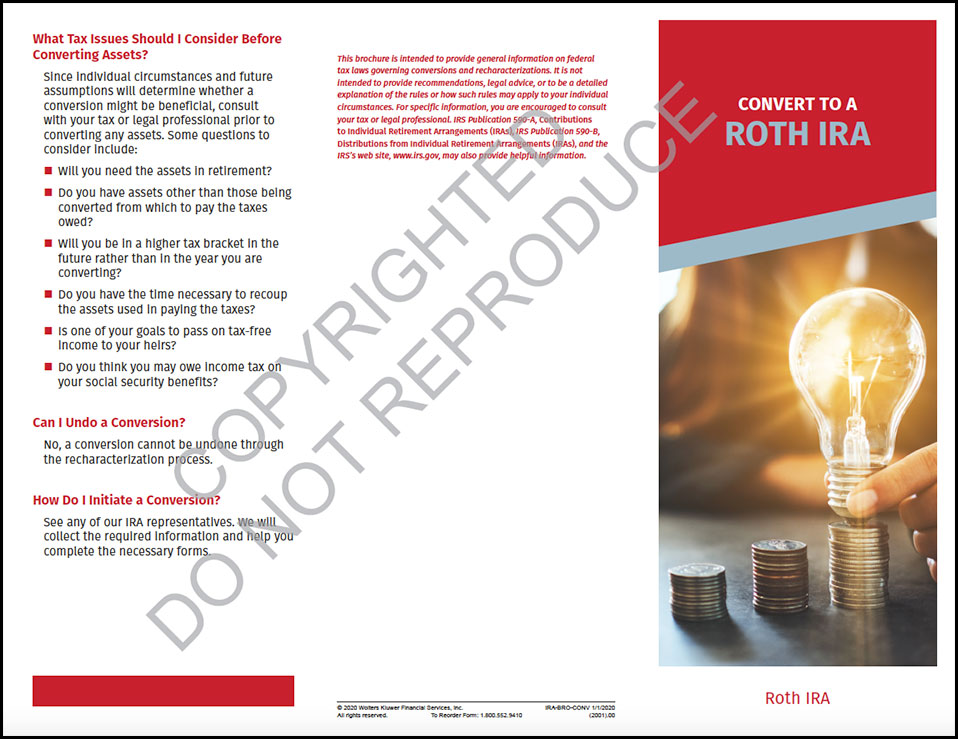

Roth IRA Brochure Wolters Kluwer

Roth IRA explained, and the 4 biggest benefits Ladies Get Paid

What is a backdoor Roth IRA? The Aero Advisor

Roth IRA Benefits, Rules, and Contribution Limits 2025

The Ultimate Roth IRA Guide District Capital Management

Quick Start Guide to a SelfDirected Roth IRA (Infographic) Finance

Distributions Of Earnings From Roth Iras Are Free Of Income Tax, Provided You.

Use This Brochure To Educate Clients On The Features And Benefits Of A Roth Ira.

You Must Log In To Order.

Related Post: