Lincoln Level Advantage Brochure

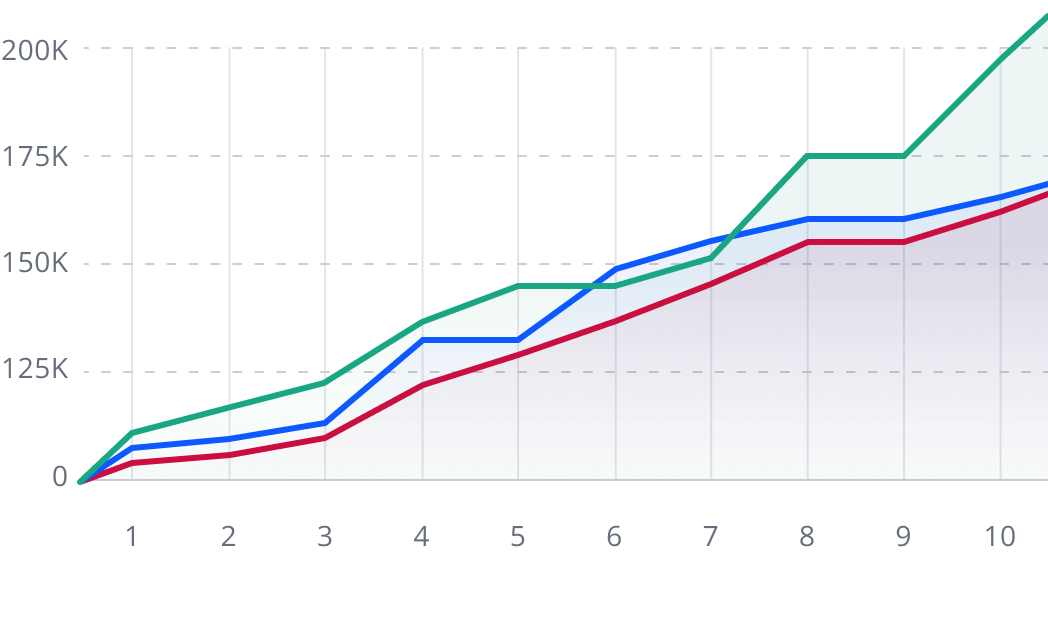

Lincoln Level Advantage Brochure - Use the lincoln level advantage® indexed variable annuity tool to see how your choice of protection, growth strategies and indices respond in different market scenarios. Lincoln heritage funeral advantage is a final expense insurance. If a market index drop is in excess of the protection level, there is the risk of. Protection level — the percentage loss that lincoln will absorb from a market downturn in indexed accounts. 4.5/5 (193 reviews) Lincoln level advantage is an indexed variable annuity. Building a portfolio that gives you opportunities to grow your savings and have a level of protection during downturns can be a challenge — but it’s possible with lincoln level. Access information about the lincoln level advantage® access product. Taking the balance of protection and growth to the next level. Discover solutions to help meet your financial goals. See lincoln level advantage 2® in action. Lincoln level advantage ® rates are for new contracts and renewals. The medicare savings program (msp) is a state medicaid program that can help to pay medicare premiums, and possibly deductibles, and coinsurance for medicare beneficiaries (elderly or. Find the balance that's right for. Lincoln level advantage 2 can be customized to fit a broad range of investment objectives and investing styles, so you and your financial professional can choose how to allocate your. 4.5/5 (193 reviews) Taking the balance of protection and growth to the next level. Extended hourslincoln special offersfair, transparent processbbb a+ rating If a market index drop is in excess of the protection level, there is the risk of. See your summary of benefits and coverage for additional details. 4.5/5 (193 reviews) Extended hourslincoln special offersfair, transparent processbbb a+ rating Extended hourslincoln special offersfair, transparent processbbb a+ rating If a market index drop is in excess of the protection level, there is the risk of. Lincoln level advantage ® rates are for new contracts and renewals. See your summary of benefits and coverage for additional details. Lincoln heritage funeral advantage is a final expense insurance. Lincoln level advantage is an indexed variable annuity. Find the balance that's right for. Lincoln level advantage ® rates are for new contracts and renewals. Lincoln heritage funeral advantage is a final expense insurance. Lincoln level advantage 2 can be customized to fit a broad range of investment objectives and investing styles, so you and your financial professional can choose how to allocate your. If you have questions about any of the options or rates shown, please contact your financial professional. Access information about the. Building a portfolio that gives you opportunities to grow your savings and have a level of protection during downturns can be a challenge — but it’s possible with lincoln level. Lincoln level advantage is an indexed variable annuity. Building on the innovations of the first generation, lincoln level advantage 2 offers investors even more opportunities for protection and growth with. Extended hourslincoln special offersfair, transparent processbbb a+ rating Extended hourslincoln special offersfair, transparent processbbb a+ rating If a market index drop is in excess of the protection level, there is the risk of. Lincoln level advantage 2 can be customized to fit a broad range of investment objectives and investing styles, so you and your financial professional can choose how. Extended hourslincoln special offersfair, transparent processbbb a+ rating Find the balance that's right for. See your summary of benefits and coverage for additional details. Building a portfolio that gives you opportunities to grow your savings and have a level of protection during downturns can be a challenge — but it’s possible with lincoln level. Lincoln level advantage ® rates are. See lincoln level advantage 2® in action. Use the lincoln level advantage® indexed variable annuity tool to see how your choice of protection, growth strategies and indices respond in different market scenarios. Protection level — the percentage loss that lincoln will absorb from a market downturn in indexed accounts. Extended hourslincoln special offersfair, transparent processbbb a+ rating Taking the balance. Use the lincoln level advantage® indexed variable annuity tool to see how your choice of protection, growth strategies and indices respond in different market scenarios. If a market index drop is in excess of the protection level, there is the risk of. Building a portfolio that gives you opportunities to grow your savings and have a level of protection during. Use the lincoln level advantage® indexed variable annuity tool to see how your choice of protection, growth strategies and indices respond in different market scenarios. Extended hourslincoln special offersfair, transparent processbbb a+ rating See lincoln level advantage 2® in action. 4.5/5 (193 reviews) If you have questions about any of the options or rates shown, please contact your financial professional. See lincoln level advantage 2® in action. Extended hourslincoln special offersfair, transparent processbbb a+ rating Use the lincoln level advantage® indexed variable annuity tool to see how your choice of protection, growth strategies and indices respond in different market scenarios. See your summary of benefits and coverage for additional details. For child care income levels by family size or other. Building on the innovations of the first generation, lincoln level advantage 2 offers investors even more opportunities for protection and growth with the industry’s first. Lincoln heritage funeral advantage is a final expense insurance. For child care income levels by family size or other child care information, visit our website at www.dhs.state.il.us. Lincoln level advantage 2 can be customized to fit a broad range of investment objectives and investing styles, so you and your financial professional can choose how to allocate your. Use the lincoln level advantage® indexed variable annuity tool to see how your choice of protection, growth strategies and indices respond in different market scenarios. Lincoln level advantage is an indexed variable annuity. 4.5/5 (193 reviews) If you have questions about any of the options or rates shown, please contact your financial professional. The medicare savings program (msp) is a state medicaid program that can help to pay medicare premiums, and possibly deductibles, and coinsurance for medicare beneficiaries (elderly or. See lincoln level advantage 2® in action. Extended hourslincoln special offersfair, transparent processbbb a+ rating Find the balance that's right for. Lincoln level advantage ® rates are for new contracts and renewals. If a market index drop is in excess of the protection level, there is the risk of. Taking the balance of protection and growth to the next level. See your summary of benefits and coverage for additional details.Dan Herr on LinkedIn What an honor for Lincoln Level Advantage to be

Lincoln National (LNC) Unveils Lincoln Level Advantage 2SM

Medicare Advantage Plans 2025 Matias Walker

Lincoln Level Advantage® indexed variable annuity Lincoln Financial

Lincoln Level Advantage Commercial YouTube

Lincoln Level Advantage 2 BShare Rates & Review Lincoln Financial

Consider Lincoln Level Advantage 2 Indexlinked annuity Justin

Lincoln Level Advantage 2 indexlinked annuity More control and

Lincoln Financial Group Strengthens Its AwardWinning Registered Index

Fillable Online LINCOLN VARIABL ANNUITIES Lincoln Level Advantage

Learn More About The Funeral Advantage Program, Including Reviews From Customers, How It Assists Seniors, And More.

Access Information About The Lincoln Level Advantage® Access Product.

Discover Solutions To Help Meet Your Financial Goals.

Building A Portfolio That Gives You Opportunities To Grow Your Savings And Have A Level Of Protection During Downturns Can Be A Challenge — But It’s Possible With Lincoln Level.

Related Post: